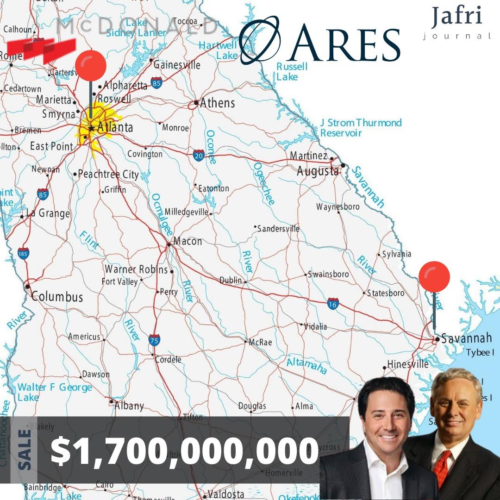

Ares Management Corp. (Michael Arougheti, CEO)

Georgia

Market: Atlanta and Savannah

Asset type: Industrial Portfolio

Buyer: Ares Management Corp. (Michael Arougheti, CEO)

Seller: McDonald Development (John McDonald, CEO)

Notes: Funds managed by a subsidiary of Ares Management Corp. have acquired two industrial portfolios consisting of 75 properties in 16 U.S. markets totaling 11.9 million square feet of space from two separate sellers for a combined price of $1.7 billion. One of the portfolios was a 14-building collection of assets in five master-planned industrial parks in Atlanta and Savannah, Ga., owned by McDonald Development that sold for $395.5 million. The portfolio totaled 2.7 million square feet and consists primarily of multi-tenant buildings occupied by 38 tenants.

Klein Enterprises (Daniel Klein, President)

11 Properties

Market: Maryland and Virginia

Asset type: Retail Portfolio

Sponsor: Klein Enterprises (Daniel Klein, President)

Lender: Sandy Spring Bank (Daniel Schrider, CEO)

Notes: Klein Enterprises has received $110 million in refinancing for 11 retail properties in numerous cities throughout Maryland and Virginia. Olney, Md.-based Sandy Spring Bank provided the refinancing package. No loan details were revealed.

Starwood Capital Group (Barry Sternlicht, CEO)

3 Communities

Market: Palm Beach

Asset type: Apartment Complex

Buyer: Starwood Capital Group (Barry Sternlicht, CEO)

Seller: Southport Financial Services (David Page, President)

Notes: Starwood Capital Group of Miami Beach paid $176.4 million for 740 apartments spread across three communities in Palm Beach County, Fla., deeds indicate. The seller was Southport Financial Services, a Tampa developer that specializes in affordable rental units.